Times Interest Earned Ratio How to Calculate It

Conceptually identical to the interest coverage ratio, the TIE ratio formula consists of dividing the company’s EBIT by the total interest expense on all debt securities. Otherwise known as the interest coverage ratio, the TIE ratio helps measure the credit health of a borrower. As a general rule of thumb, the higher the times interest earned ratio, the more capable the company is at paying off its interest expense on time. However, a company with an excessively high TIE ratio could indicate a lack of productive investment by the company’s management. An excessively high TIE suggests that the company may be keeping all of its earnings without re-investing in business development through research and development or through pursuing positive NPV projects. This may cause the company to face a lack of profitability and challenges related to sustained growth in the long term.

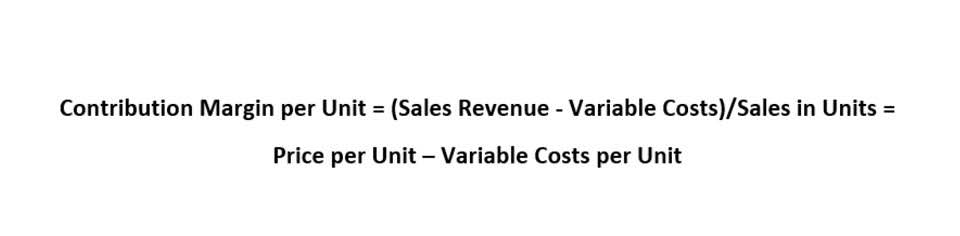

We will also explore its relationship to the risk of default and the importance of maintaining a healthy TIE ratio. The times interest earned (TIE) ratio, also known as the interest coverage ratio, measures how easily a company can pay its debts with its current income. To calculate this ratio, you divide income by the total interest payable on bonds or other forms of debt. After performing this calculation, you’ll see a number which ranks the company’s ability to cover interest fees with pre-tax earnings. Generally, the higher the TIE, the more cash the company will have left over. The Times Interest Earned Ratio is a key financial ratio that measures the profitability of a company’s operations.

Times Interest Earned Ratio (TIE)

Conversely, a low TIE may indicate inefficiencies in the business model, prompting management to explore strategies for improving profitability and cost management. The resulting ratio shows the number of times that a company could pay off its interest expense using its operating income. Here, we can see that Harrys’ TIE ratio increased five-fold from 2015 to 2018. This indicates that Harry’s is the times interest earned ratio provides an indication of managing its creditworthiness well, as it is continually able to increase its profitability without taking on additional debt. If Harry’s needs to fund a major project to expand its business, it can viably consider financing it with debt rather than equity. Startup firms and businesses that have inconsistent earnings, on the other hand, raise most or all of the capital they use by issuing stock.

While it’s unnecessary for a company to be able to pay its debts more than once, when the ratio is higher it indicates that there’s more income left over. A higher discretionary income means the business is in a better position for growth, as it can invest in new equipment or pay for expansions. It’s clear that the company’s doing well when it has money to put back into the business. A common solvency ratio utilized by both creditors and investors is the times interest earned ratio.

Definition of Times Interest Earned Ratio

Beyond financial stability, TIE provides valuable insights into a business’s operational efficiency. This metric quantifies the extent to which a business can offset its interest expenses using its earnings before interest and taxes (EBIT). In this article, we’ll tackle the concept of TIE, why it’s crucial for businesses, how to measure it, what constitutes a good TIE ratio, and strategies for improving it. Given the decrease in EBIT, it’d be reasonable to assume that the TIE ratio of Company B is going to deteriorate over time as its interest obligations rise simultaneously with the drop-off in operating performance. The TIE’s main purpose is to help quantify a company’s probability of default.

Avoiding Dividend Traps: Tips for Canadian Investors – Yahoo Canada Finance

Avoiding Dividend Traps: Tips for Canadian Investors.

Posted: Tue, 07 Nov 2023 15:00:00 GMT [source]

Such a situation may lead to difficulties in securing financing or even jeopardize the company’s ongoing operations if debt servicing becomes unsustainable. To better understand the financial health of the business, the ratio should be computed for a number of companies that operate in the same industry. If other firms operating in this industry see TIE multiples that are, on average, lower than Harry’s, we can conclude that Harry’s is doing a relatively better job of managing its degree of financial leverage. In turn, creditors are more likely to lend more money to Harry’s, as the company represents a comparably safe investment within the bagel industry.

Example of the Times Interest Earned Ratio

Earn more money and pay your dang debts before they bankrupt you, or, reconsider your business model. In some respects, the times interest earned ratio is considered a solvency ratio. Since interest and debt service payments are usually made on a long-term basis, they are often treated as an ongoing, fixed expense. As with most fixed expenses, if the company is unable to make the payments, it could go bankrupt, terminating operations. The times interest earned (TIE) ratio, sometimes called the interest coverage ratio or fixed-charge coverage, is another debt ratio that measures the long-term solvency of a business. It measures the proportionate amount of income that can be used to meet interest and debt service expenses (e.g., bonds and contractual debt) now and in the future.

When the TIE ratio is low, it raises red flags, suggesting that the company may struggle to meet its debt payments. This situation can potentially lead to financial distress, credit rating downgrades, or even default, which can have severe consequences for the company’s operations and reputation. With the TIE ratio, users can determine the capability of an organization is paying off all its debt obligations with the net income earned by the same.

Times Interest Earned (TIE) ratio is a vital financial metric that measures a company’s ability to meet its interest payment obligations on debt. By comparing pre-tax earnings to total interest payable, the TIE ratio provides valuable insights into a company’s financial health, risk of default, and capacity to generate consistent earnings. A higher TIE ratio indicates a stronger financial position, making the company more attractive to investors and lenders. By monitoring and managing their TIE ratio, companies can ensure their ability to meet debt obligations, access credit facilities, and pursue growth opportunities.

As you can see, Barb’s interest expense remained the same over the three-year period, as she has added no additional debt, while her earnings declined significantly. If you are a small business with a limited amount of debt, then the ratio is not all that important. The fundamental premise of technical analysis lies in identifying recurring price patterns and trends, which can then be used to forecast the course of upcoming market trends. We have delved into nearly all established https://www.bookstime.com/ methodologies, including price patterns, trend indicators, oscillators, and many more, by leveraging neural networks and deep historical backtests. As a consequence, we’ve been able to accumulate a suite of trading algorithms that collaboratively allow our AI Robots to effectively pinpoint pivotal moments of shifts in market trends. When discussing investment strategies and successful investors, it is impossible to ignore the legendary investor Warren Buffett.

How To Overcome The Limitations Of Times Interest Earned Ratio?

While a higher calculation is often better, high ratios may also be an indicator that a company is not being efficient or not prioritizing business growth. A higher TIE ratio suggests that the company is generating substantial profits relative to its interest costs. This showcases effective financial management, as it demonstrates that the company’s core operations are generating enough income to cover its financial obligations. A higher TIE ratio usually suggests that a company has a more robust financial position, as it signifies a greater capacity to meet its interest obligations comfortably. This, in turn, may make it more attractive to investors and lenders, as it indicates lower default risk.

- Given the decrease in EBIT, it’d be reasonable to assume that the TIE ratio of Company B is going to deteriorate over time as its interest obligations rise simultaneously with the drop-off in operating performance.

- A healthy TIE ratio can make a company more attractive to potential investors, as it instills confidence in the company’s financial strength and ability to meet its financial commitments.

- Streamlining their operations and looking for ways to cut costs on a 360-degree front will make it work.

- Accounting firms can work with you along the way to help keep your ratios in check.

- The cost of capital for issuing more debt is an annual interest rate of 6%.

- The Times Interest Earned Ratio (TIE ratio) is a measure of a company’s ability to generate profit from its interest-bearing assets.

- Here, Company A is depicting an upside scenario where the operating profit is increasing while interest expense remains constant (i.e. straight-lined) throughout the projection period.